The Climate Winners and Loser of the One Big Beautiful Bill Act

I read and analyzed (OK, with the help of AI) the One Big Beautiful Bill Act (OBBB) and thought I’d share my views on the climate winners and losers, which I’ve listed below. At a high level, the OBBB undermines U.S. and global climate goals by prioritizing fossil fuel production and dismantling key clean energy and environmental programs, leading to substantial increases in greenhouse gas emissions and setbacks in the energy transition.

Title V – Committee on Energy and Natural Resources (Sections 50101–50501) expands oil, gas, and coal leasing on federal lands, offshore, and in Alaska, while repealing taxes like the oil excise tax (Sec. 50402) and providing financing for fossil fuel projects (Sec. 50403). Title VI – Committee on Environment and Public Works (Sections 60001–60026) rescinds critical climate initiatives, including the $27 billion Greenhouse Gas Reduction Fund (Sec. 60002), clean water programs (Sec. 60003, 60005, 60019), and environmental justice grants (Sec. 60016). Additionally, Title VII – Finance, Subtitle A—Tax phases out tax credits for electric vehicles (by September 30, 2025), wind and solar (by December 31, 2027), and clean hydrogen (by January 1, 2028), with strict “foreign entity of concern” (FOEC) rules limiting eligibility. These provisions collectively shift investment away from renewables, entrenching fossil fuel reliance.

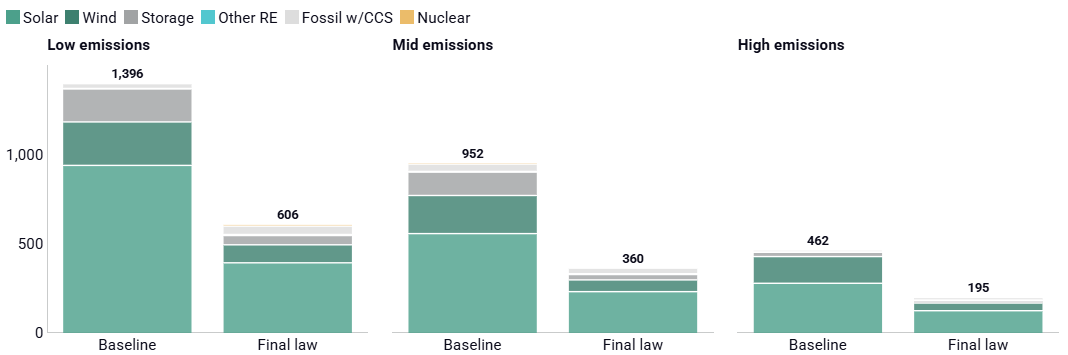

The OBBB’s climate impacts are stark. The Rhodium Group projects an 8-12% rise in U.S. greenhouse gas emissions by 2035—190–470 million metric tons of CO2 equivalent annually, comparable to adding 50-100 million gas-powered cars to the roads. This trajectory undermines America’s pledge to cut emissions by 61–66% from 2005 levels by 2035, pushing global warming beyond the Paris Agreement’s 1.5°C target. The Center for American Progress estimates a 57–72% drop in renewable energy capacity additions (300–600 gigawatts) by 2035, jeopardizing $220–500 billion in investments and 770,000–2.3 million clean energy jobs. Weakened methane regulations and expanded fossil fuel production exacerbate these risks, while reduced clean energy capacity threatens grid reliability as demand rises from electrification and data centers.

Exhibit 1: Cumulative new clean additions to the grid, 2025-2035 (GW)

Source: Rhodium Group

Limited concessions, such as extended tax credits for nuclear, geothermal, and hydropower until 2033 and the removal of a proposed wind/solar excise tax, provide marginal climate benefits but are insufficient to offset the bill’s fossil fuel bias. The bill risks grid reliability by reducing clean energy capacity amid rising demand from AI data centers and electrification, potentially leading to outages and higher energy costs. Globally, the OBBBA undermines U.S. climate leadership, ceding clean energy innovation to countries like China and exacerbating climate-driven risks like hurricanes, heatwaves, and wildfires, making it a significant setback for global decarbonization efforts.

Winners:

Oil and Gas: OBBB positions the oil and gas industry as a primary beneficiary through a raft of provisions supporting exploration, production, and infrastructure development. While these measures align with the Trump administration’s goals of achieving energy dominance and independence, they significantly entrench reliance on fossil fuels, countering global efforts to transition to renewables and exacerbating climate challenges.

- Sec. 50101 accelerates leasing for oil and gas exploration and production federal lands, streamlining permitting processes and reducing regulatory barriers. This reverses restrictions imposed by prior environmental regulations, enabling companies like ExxonMobil and Chevron to access vast federal lands for drilling with fewer delays, boosting domestic production but increasing greenhouse gas emissions.

- Sec. 50102 expands offshore oil and gas leasing, likely in areas such as the Gulf of Mexico and Atlantic coast, with expedited permitting and fewer environmental reviews. This opens new drilling opportunities but heightens risks of oil spills and marine ecosystem damage, further locking in fossil fuel dependency.

- Sec. 50402 eliminates an excise tax on oil, lowering production and consumer costs. This makes oil more competitive against renewables, potentially increasing consumption.

- Sec 50403 provides loans or subsidies for oil and gas projects, supporting infrastructure like pipelines and refineries. This diverts capital from clean energy, reinforcing fossil fuel dominance and contributing to a projected $220–500 billion loss in clean energy investments by 2035.[1]

Nuclear: spared in both the house and senate versions, the final bill expands support for advanced nuclear by broadening the definition of qualifying projects and extending the 10% energy community bonus under IRC § 45Y to areas with employment in nuclear-related activities. Unlike wind, solar, and electric vehicle (EV) tax credits, which are phased out by 2027 or earlier, nuclear, geothermal, and hydropower tax credits are preserved until 2033.

Utility-scale battery storage: originally the tax credits for energy storage was shortened by the version of the bill passed by the House of Representatives. However, the final version passed by Senate – which is now law – retains the Investment Tax Credit (ITC) for energy storage under Internal Revenue Code Section 48, extended until 2033, unlike the phase-out of wind, solar, and EV credits by 2027. This preservation allows utility-scale battery projects to benefit from up to 30% cost reductions, supporting grid reliability amid rising electricity demand from AI data centers and electrification.

Source: Constellation Energy, Crane Clean Energy Center

Losers:

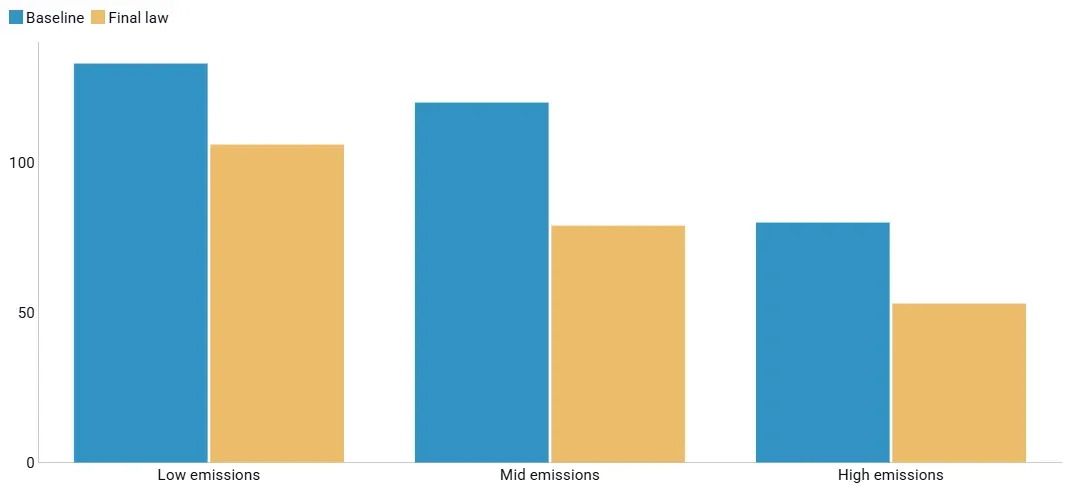

Electric Vehicles: the $7,500 tax credit for new EVs and $4,000 credit for used EVs under Internal Revenue Code Section 30D (Clean Vehicle Credit) and related provisions are terminated within 180 days of enactment (by September 30, 2025). Credits under Section 45W for commercial EVs are also phased out by September 30, 2025. After the rollback of EPA vehicle standards and Congress nullifying EPA’s waiver to California that had enabled the state to establish its own vehicle standards, it stands to reason that the transition from internal combustion engine vehicles to electric vehicles will be delayed.

The biggest loser commercially is Tesla. The $7,500 credit was infamously only available on 29 models that met requirements under the Inflation Reduction Act, due to specifications around where they were assembled and the materials sourced. Tesla has 10 of the 29 models that are eligible, and the credit wasn’t available to any of the EVs sold by BMW, Kia, and Volkswagen.

Wind and Solar: these projects now face a shorter window to qualify for tax credits. Title VII – Finance, Subtitle A – Tax phases out wind and solar tax credits (PTC under Section 45 and ITC under Section 48 of the Internal Revenue Code), and adds strict FOEC rules limiting eligibility. Projects now must start construction by July 4, 2026, or be in service by December 31, 2027, to qualify.

Clean Hydrogen: the IRA’s green hydrogen production credit (45V) will be phased out by January 1, 2028, with strict FOEC rules limiting eligibility for projects using foreign components in the interim.

Exhibit 2: Number of light-duty electric vehicles on the road in 2035. Million vehicles, % change from baseline

Source: Rhodium Group

The OBBB reflects a broader tension between short-term economic priorities and long-term climate imperatives. While it may deliver energy price relief and bolster fossil fuel industries, its rollback of clean energy incentives risks isolating America in a world racing toward decarbonization. Policymakers must now weigh whether these trade-offs are worth the cost to the climate and future generations.