Nuclear Fusion: Still 20 Years Away?

The running joke on nuclear fusion is that fusion is always a decade away. It seems like it has been for last the 50 or so years, as scientists have struggled to harness fusion as a useable energy source on earth.

Fusion's promise has long been evident: it offers the tantalizing prospect of permanent energy independence with safe, clean, and firm power being supplied reliably to a low-carbon grid. At the same time, the fusion industry has faced well-documented challenges in achieving and sustaining the extreme temperatures and pressures needed for stable plasma confinement while developing materials that can withstand intense radiation and heat. Additionally, high costs, long development timelines, and the difficulty of producing more energy than is consumed have hindered progress toward commercial viability.

However, recent developments have taken fusion forward in a meaningful manner, and I believe that we are in the “final decade away” from fusion baseload power being supplied to the grid. With novel technology, advanced materials, unprecedented computing power, and private sector ambition, the path to fusion power has been laid out at a time when the world’s energy challenges are more acute than ever.

This whitepaper provides a brief overview of nuclear fusion – just the basics – and a snapshot of the funding and development status of the nuclear industry and its supply chain, which has long been viewed as a bottleneck to commercialization. It profiles Focused Energy, a laser confinement fusion company which I believe is best placed to deliver commercial fusion plants, and lists several other promising fusion companies that are racing to that milestone. I conclude with a set of recommendations to help achieve fusion electricity generation on the grid by the end of the 2030s.

What is nuclear fusion?

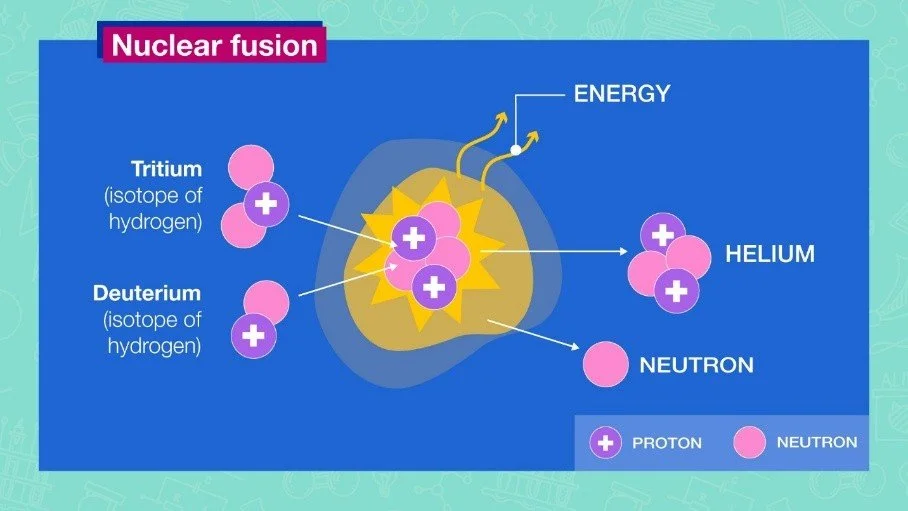

Nuclear fusion is the process that powers stars, including the Sun. It involves merging lighter atomic nuclei, such as hydrogen, to form a heavier nucleus, releasing energy. It relies on the potentially abundant fuels of deuterium from seawater, and tritium bred from lithium. There are two primary methods for nuclear fusion, which differ by the way in which the tritium and deuterium are trapped for fusion to occur. Magnetic confinement uses powerful magnetic fields to trap hot plasma in a donut-shaped device (tokamak or stellarator), keeping it stable long enough for fusion to occur. Inertial or laser confinement compresses a tiny fuel pellet using intense laser or particle beams, rapidly heating and squeezing it to fusion conditions before it can expand.

Source: International Atomic Energy Agency

Nuclear fusion is different from fission in the following key respects:

1) Energy Density: fusion has an energy density four times that of fission and millions that of fossil fuels

2) Direction of Reaction: fusion involves combining two light atomic nuclei to form a heavier nucleus, releasing energy in the process. Fission involves splitting a heavy atomic nucleus into two or more lighter nuclei, releasing energy.

3) Waste: fusion produces minimal, short-lived radioactive waste; fission generates long-lived radioactive waste - see the "elephant foot" in Chernobyl

4) Safety: fusion has lower risk of catastrophic failure or weapons proliferation compared to fission. Fusion reactions are inherently self-limited. If the conditions needed to sustain the reaction are compromised (e.g., loss of confinement, cooling of the plasma), the reaction will stop naturally.

For these reasons, fusion has been hailed as the endgame of the energy story that has started with humans discovering fire and will culminate with humans mastering the way that the Universe creates its own energy.

Why now?

In late 2022, two innovations were revealed that had the potential to truly change the world. In November 2022, ChatGPT was unveiled. And that story has been well-documented. To lesser fanfare but with just as much potential for disruption, the National Ignition Facility (NIF) at Lawrence Livermore National Laboratory produced more energy from fusion than was delivered to the target by the lasers – achieving a fusion energy output of around 3.15 MJ from a laser input of about 2.05 MJ. This corresponds to a gain of c.1.5 – known as scientific gain or ignition.

Since the National Ignition Facility’s historic achievement in December 2022, nuclear fusion has entered a new era of accelerated progress. The milestone proved that controlled fusion ignition is possible in a laboratory setting, validating decades of theory and experimentation. This success galvanized both public and private sectors worldwide, prompting governments in the U.S., UK, Germany, and Japan to launch large-scale fusion initiatives.

In the past year, several public-private partnerships have moved forward with ambitious timelines. The German government announced a “Fusion 2040” program that will invest directly into private companies, with over €1 billion committed to fusion R&D through 2028. The Japanese government’s “Moonshot R&D” program’s 2024 cohort was entirely fusion-focused, backing 3 fusion R&D projects. The United Kingdom’s Fusion Futures program combines £650+ million in funding, strategic infrastructure, industry support, workforce training, and international ties to transition the UK from fusion research to commercial deployment. The milestone-based Fusion Development Program and Fusion Innovative Research Engine Collaborative (FIRE) was announced by the U.S. Department of Energy. The Fusion Development Program selected eight companies to sign contracts to deliver comprehensive pilot plant designs, hedging its bets across fusion confinement approaches. Two companies are focused on inertial confinement (lasers), two on stellarators, two on tokamaks, and two on innovative concepts like mirror magnetic confinement and z-pinches. The FIRE program provides $107M in funding for six projects to support the materials and technologies required by the diverse set of fusion concepts.

Simultaneously, private companies have rapidly advanced their own technologies, bolstered by unprecedented investment and breakthroughs in supporting fields. High-temperature superconductors, additive manufacturing, machine learning-driven reactor simulations, and advanced materials for plasma-facing components are all helping to overcome fusion's traditional bottlenecks. Startups such as Helion, TAE Technologies, Commonwealth Fusion Systems, and First Light Fusion are competing to be first to market with scalable systems, some promising pilot plants before 2030. As the world faces increasing pressure to decarbonize while ensuring energy security, fusion’s potential as a clean, virtually limitless power source has moved from theoretical possibility to a realistic solution—creating a wave of optimism that fusion could be part of the global energy mix within a generation.

Despite decades of skepticism around fusion’s viability, companies surveyed by the Fusion Industry Association for their annual report continue to be confident in their projections: 89% of surveyed companies believe they will connect fusion electricity to the grid by the end of the 2030s, with 70% targeting 2035 or earlier. These respondents have been consistent in their projected timeline since the Fusion Industry Association began surveying companies in 2021. Unlike past fusion predictions that missed their marks, this consistency over multiple years suggests that companies are hitting milestones and building credibility, especially as several begin construction on pilot and prototype plants.

Funding (of companies)

According to the Fusion Industry Association (FIA), there are at least 45 companies working to commercialize fusion energy around the world. Funding has increased by 15%, or $900M YoY to $7.1B total raised through 2024. Governments have stepped in meaningfully, with public funding increasing 57%, or $155M YoY to $426 M total raised through 2024.[1] This increase in public funding directed towards private companies reflects the recognition that it will be a business, not a government, that will someday deliver fusion energy to the grid. The growing commitment from governments highlights a shift toward public-private partnerships as the model for future fusion development.

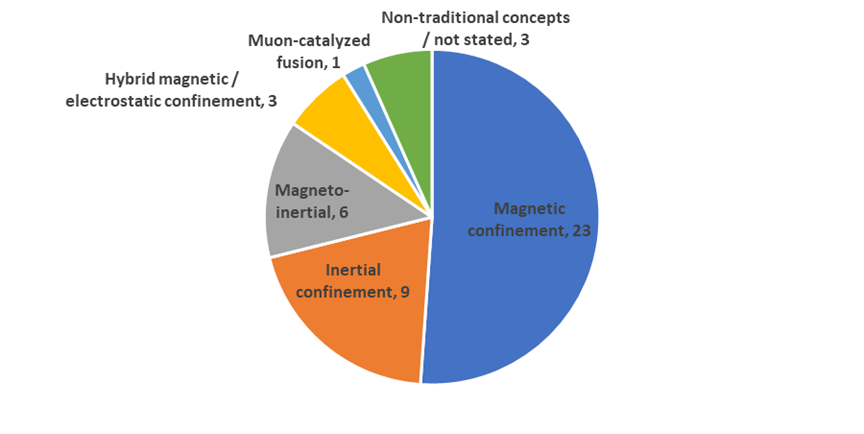

Exhibit 1: The majority of fusion companies are focused on magnetic and inertial confinement approaches.

Source: Fusion Companies Survey by the Fusion Industry Association

Today, the U.S. private fusion energy sector counts 25 verified companies which have secured over $6B in private funding, most of which aim to deliver electricity to the grid in the 2030s.[2]

Exhibit 2: Location of fusion companies (by primary HQ). 25 verified fusion companies in the U.S. have attracted more than $6B in cumulative investment.

Source: FIA, CATF

Many of these companies are building prototype and proof of concept machines. Once those deliver results, they will de-risk investment, in turn unlocking a vast pool of lower-risk capital that will bring the needed leap in funding needed for an abundant energy future powered by fusion.

Investment (towards supply chain)

In 2024, private fusion companies collectively spent over $434 million on their supply chains—nearly double the amount spent in 2023—and they anticipate a further 25% increase in 2025.[3] This surge reflects progress toward pilot plant deployment by companies like Commonwealth Fusion Systems, Helion, and Focused Energy. However, each fusion approach requires different, highly specialized components, making it difficult for suppliers to standardize or scale confidently across the sector.

A major constraint highlighted is the limited number of precision engineering firms that can meet fusion’s bespoke technical requirements. While off-the-shelf components are sometimes available, many critical systems—such as HTS magnets, vacuum components, and tritium-compatible pumps—require custom manufacturing. Suppliers often have long backlogs and limited scalability, especially smaller firms without resources to expand rapidly. This contributes to the “chicken-and-egg” dilemma: suppliers want firm commitments before investing, but fusion companies can't guarantee future volumes until they hit technical milestones.

For companies focused on laser inertial confinement, while lasers and laser components (e.g. diodes, laser glass) are considered to be facing supply constraints today, only 1 respondent to The Fusion Industry Association's survey expect this to be a constraint in the future.

Among the 57 suppliers surveyed by the FIA, 83% identified risks in serving the fusion industry—mainly due to unclear demand timelines, limited communication, and lack of standardized requirements. Still, 86% saw increased business with fusion companies in the past year and collectively invested over $230 million in new capacity, staff, and technologies. Nearly half said they were willing to invest further if fusion companies shared some of the financial risk through mechanisms like minimum orders or joint development ventures.

Spotlight: Focused Energy

Focused Energy is advancing laser-driven inertial confinement fusion, building on the groundbreaking work of Lawrence Livermore National Laboratory’s National Ignition Facility (NIF). Founded in 2021 by Dr. Markus Roth and Thomas Forner, and led by CEO Scott Mercer, the company recruited three of the four leaders of NIF’s ignition program, which achieved scientific gain (Q>1) in December 2022. This milestone, where more energy was produced than input, shifts the challenge from proving fusion’s feasibility to addressing engineering and commercialization hurdles.

With the physics validated, Focused Energy is tackling scalable systems and supply chains, distinguishing it from magnetic confinement or experimental fusion approaches still facing scientific uncertainties. The company’s direct-drive laser fusion method uses a focused proton beam to ignite millimeter-scale deuterium-tritium fuel targets, or “pearls,” triggering fusion reactions that generate heat. This heat produces steam to drive turbines, delivering clean energy to the grid. Focused Energy estimates that three Coca-Cola cans’ worth of seawater-derived deuterium and tritium could power a city like San Francisco for a day.

Focused Energy is developing low-cost, high-precision fuel pearls at its targetry lab in Darmstadt, Germany, designed for commercial-scale production. It is also optimizing its laser systems, called “lighthouses,” at a new $65 million Laser Development Facility in the Bay Area, near Lawrence Livermore National Laboratory. In a recent deal, Focused Energy acquired two of the world’s most powerful lasers from Amplitude Laser, each costing approximately $40 million, to enhance its testing capabilities.

The company’s technological edge lies in its advanced, scalable, and efficient laser systems. Unlike NIF’s 0.5% efficient flashlamp lasers, Focused Energy’s diode-pumped, solid-state lasers achieve 10-15% efficiency, a 20-30 times improvement, while its direct-drive approach boosts efficiency by another 30 times. These modular laser arrays, used in industrial and defense applications and comparable to data center server racks, allow maintenance without facility shutdowns, ensuring reliability for baseload power. Focused Energy projects a gain of 25 for its pilot plant and over 75 for commercial plants, enhancing economic viability.

Focused Energy is one of eight companies in the U.S. Department of Energy’s (DOE) milestone-based Fusion Development Program and one of three to complete milestones, uniquely achieving two: a report on high-gain target design, outlining the path from NIF’s ignition to commercial fusion, and an experimental campaign optimizing laser-generated proton focusing, critical to its inertial fusion approach. Commercially, the company engages nuclear-experienced operators and governments through DOE partnerships and Germany’s Fusion 2040 program. In March 2025, Focused Energy signed an agreement with RWE and the German state of Hesse to develop a fusion plant at a decommissioned nuclear fission site. By licensing power plant designs and proprietary pearls, and generating near-term revenue from laser and target IP sales, Focused Energy aligns with investor timelines, targeting a $100 billion order book by 2030.

Focused Energy has raised over $200 million in funding, including $82 million in private capital across three rounds and significant public grants, positioning it to advance its commercialization roadmap. A 2021 seed round of $15 million, led by Prime Movers Lab with investors like Alex Rodriguez, was followed by an $11 million Series A in 2023, also led by Prime Movers Lab. Public funding includes a $50 million SPRIN-D award from Germany’s Federal Agency for Disruptive Innovation, a $3 million DOE grant, and $3 million from the German state of Hesse, supporting laser and target development and the Bay Area facility. This robust financial backing, combined with partnerships like the Amplitude Laser deal, enables Focused Energy to address engineering challenges and build a global supply chain for fusion power.

Despite its progress, Focused Energy faces challenges shared by fusion peers, including building a robust supply chain for thousands of laser modules, sustaining rapid fusion reactions at 10 times per second, and efficiently capturing energy for grid integration. Mercer projects a pilot plant by the mid-2030s, commercial deployments by the late 2030s, and scaled deployment in the 2040s, aiming to transform the global energy landscape with clean, abundant fusion power.

Other interesting companies working on fusion:

1. Commonwealth Fusion Systems: develops compact tokamak fusion reactors using high-temperature superconducting (HTS) magnets, aiming for net energy gain with its SPARC prototype by 2026 and commercial ARC plant by the early 2030s. It raised $1.8 billion in a 2021 Series B round, backed by investors like Bill Gates, Google, and Eni, and was spun out of MIT.

2. First Light Fusion: Oxford, UK-based First Light Fusion develops inertial confinement fusion using a high-velocity projectile to compress fuel, recently pivoting to supply technology to other fusion companies. It has raised $107 million since 2011, with plans for a £60 million raise by January 2025, and is backed by investors like Oxford Science Enterprises.

3. Helion Energy: based in Everett, Washington, Helion pursues pulsed non-ignition fusion using a field-reversed configuration to produce electricity directly, targeting commercial power by 2028 via its Polaris prototype. It raised $425 million in a January 2025 Series F round, with total funding of $1.03 billion from investors like Sam Altman, BlackRock, and Microsoft, which signed a power purchase agreement for 2028.

4. Marvel Fusion: based in Munich, Germany, Marvel Fusion uses laser-driven inertial confinement with particle acceleration for efficient fusion, partnering with Colorado State University to build a demonstration facility by 2027. It has raised €165.3 million ($178 million), including a €63 million round in 2024, and leverages semiconductor manufacturing techniques for fuel target production.

5. Pacific Fusion: Fremont, California-based Pacific Fusion develops inertial confinement fusion using electromagnetic pulses to compress fuel, aiming for a scalable, efficient approach with a milestone-based funding model. It raised $900 million in a Series A round in October 2024, led by investors including Eric Lander, and collaborates with General Atomics to target net facility gain by 2030.

6. Proxima Fusion: Munich-based Proxima Fusion develops quasi-isodynamic (QI) stellarators, leveraging advanced computational design to create stable, efficient fusion reactors. It has raised €185 million ($199 million), including a €130 million Series A in 2024 from Balderton Capital and Cherry Ventures, and was founded in 2023 by ex-Max Planck and MIT researchers targeting commercial fusion by the mid-2030s.

7. Shine Technologies: Located in Janesville, Wisconsin, Shine Technologies focuses on neutron generation for medical isotopes and industrial testing, with plans to scale to full fusion reactors using a hybrid approach. It has raised $778 million, including $90 million noted in 2024, and is generating revenue from non-fusion applications while advancing fusion technology.

8. TAE Technologies: based in Foothill Ranch, California, TAE develops aneutronic fusion using a beam-driven field-reversed configuration with hydrogen-boron fuel, aiming for minimal radioactive waste and a commercial Da Vinci plant by the early 2030s. It has raised $1.79 billion in total, including $150 million in June 2025 from investors like Alphabet and Chevron, and began constructing its Copernicus reactor in 2022, set to operate by 2025. Spun out of University of California, Irvine.

9. Thea Energy: utilizes a stellarator-based fusion approach, focusing on computational design and simpler magnet systems to accelerate commercialization. It raised a $20 million Series A in February 2024, with Prelude Ventures leading the round with participation from 11.2 Capital, Anglo American, Hitachi Ventures, Lowercarbon Capital, Mercator Partners, Orion Industrial Ventures and Starlight Ventures. Founded in 2022 with technology developed at Princeton University.

10. Tokamak Energy: based in Oxfordshire, UK, Tokamak Energy develops compact spherical tokamaks with HTS magnets, achieving 100 million °C plasma in its ST40 prototype and aiming for a pilot plant by 2034. It raised $125 million in November 2024, bringing total funding to $336 million from investors like Future Planet Capital and In-Q-Tel, and also generates revenue from its magnet business.

11. Xcimer Energy: headquartered in Denver, Colorado, Xcimer Energy pursues laser-driven inertial confinement fusion, developing a 10-megajoule laser system for efficient, high-energy fusion, targeting a commercial plant by the mid-2030s. It has raised $117.8 million, including $109 million from Hedosophia and Breakthrough Energy Ventures, and is part of the DOE’s Milestone-Based Fusion Program.

12. Zap Energy: based in Everett, Washington, Zap Energy builds compact Z-pinch fusion reactors using sheared-flow stabilization, aiming for low-cost, magnet-free fusion with its FuZE device and a commercial plant by the early 2030s. It has raised $327 million from investors like Chevron and Breakthrough Energy Ventures, with recent funding supporting progress toward net energy gain.

Recommendations for the fusion industry:

1. Increase investment in technology and engineering research: this may seem both obvious and redundant given the time I spent earlier laying out the private and public funding provided to the industry, but I am advocating for a shift in funding from basic plasma physics to applied technology and engineering research, addressing practical challenges like reactor design, fuel cycles, and power extraction systems. Between 2020 and 2023, the U.S. Department of Energy’s Fusion Energy Sciences program allocated only 1.2% ($36 million) of its $740.8 million budget to commercialization efforts, underscoring the need for increased investment in scalable solutions. By prioritizing engineering advancements, such as high-field magnets and tritium breeding, fusion can move closer to practical, grid-ready power plants by the 2030s, reducing reliance on purely scientific milestones.

2. Develop materials for extreme fusion conditions: developing materials capable of withstanding the extreme conditions inside fusion reactors—temperatures exceeding 100 million °C, intense neutron bombardment, and strong magnetic fields—is critical for commercial viability. Current materials, such as steel or vanadium-based alloys, degrade under high neutron fluxes, and new solutions are needed to ensure reactor durability and minimize radioactive waste. Initiatives like the DOE’s CHADWICK program at Ames National Laboratory are researching vanadium alloys, while facilities like the International Fusion Materials Irradiation Facility (IFMIF) could provide essential testing environments. Investing in advanced materials science, including ceramics and composites, will enable reactors to operate safely and efficiently over decades, a prerequisite for cost-competitive fusion power.

3. Establish clear and coherent regulatory frameworks: clear, tailored regulatory framework for fusion energy is essential to balance safety with innovation, avoiding the restrictive regulations designed for fission reactors. Fusion’s unique safety profile—no risk of meltdowns and minimal long-lived waste—has led the U.S. and UK to treat fusion facilities like medical or industrial radiation sources, but global harmonization is needed to support private sector development. By establishing international standards and streamlining licensing processes, regulators can reduce uncertainty, encourage investment, and enable companies to deploy commercial plants by the 2030s.

4. Build scalable supply chains and infrastructure: commercial fusion requires robust supply chains for specialized components like high-temperature superconducting magnets, tritium fuel, and high-power lasers, alongside infrastructure to integrate fusion into existing energy grids. Partnerships with industries experienced in nuclear engineering, such as Babcock International, and leveraging sites from decommissioned coal or fission plants can lower costs and accelerate deployment. By investing in manufacturing capabilities and grid-compatible infrastructure, fusion developers can ensure scalability and economic viability.

5. Train a diverse workforce: building a skilled and diverse workforce in plasma physics, materials science, and fusion engineering is vital to meet the demands of designing, constructing, and operating commercial fusion reactors. The DOE’s Fusion Energy Strategy 2024 highlights the need to close workforce gaps, yet current training programs are underfunded, limiting the pipeline of qualified engineers and scientists.

6. Enhance public engagement and acceptance: to gain public trust and acceptance, fusion developers must proactively address safety and proliferation concerns through transparent engagement and robust risk management. Fusion’s safety advantages—no chain reactions, minimal long-lived waste—must be communicated clearly to counter misconceptions linking it to fission, using accessible analogies like the sun’s fusion process. Mitigating risks, such as managing short-lived tritium emissions through closed fuel cycles (as planned for ITER) and recycling activated materials, is crucial for regulatory approval and public confidence.

[1] The Global Fusion Industry Report 2024, Fusion Industry Association

[2] Fusion on the Grid, Clean Air Task Force

[3] The Fusion Industry Supply Chain Report 2025, Fusion Industry Association